Published

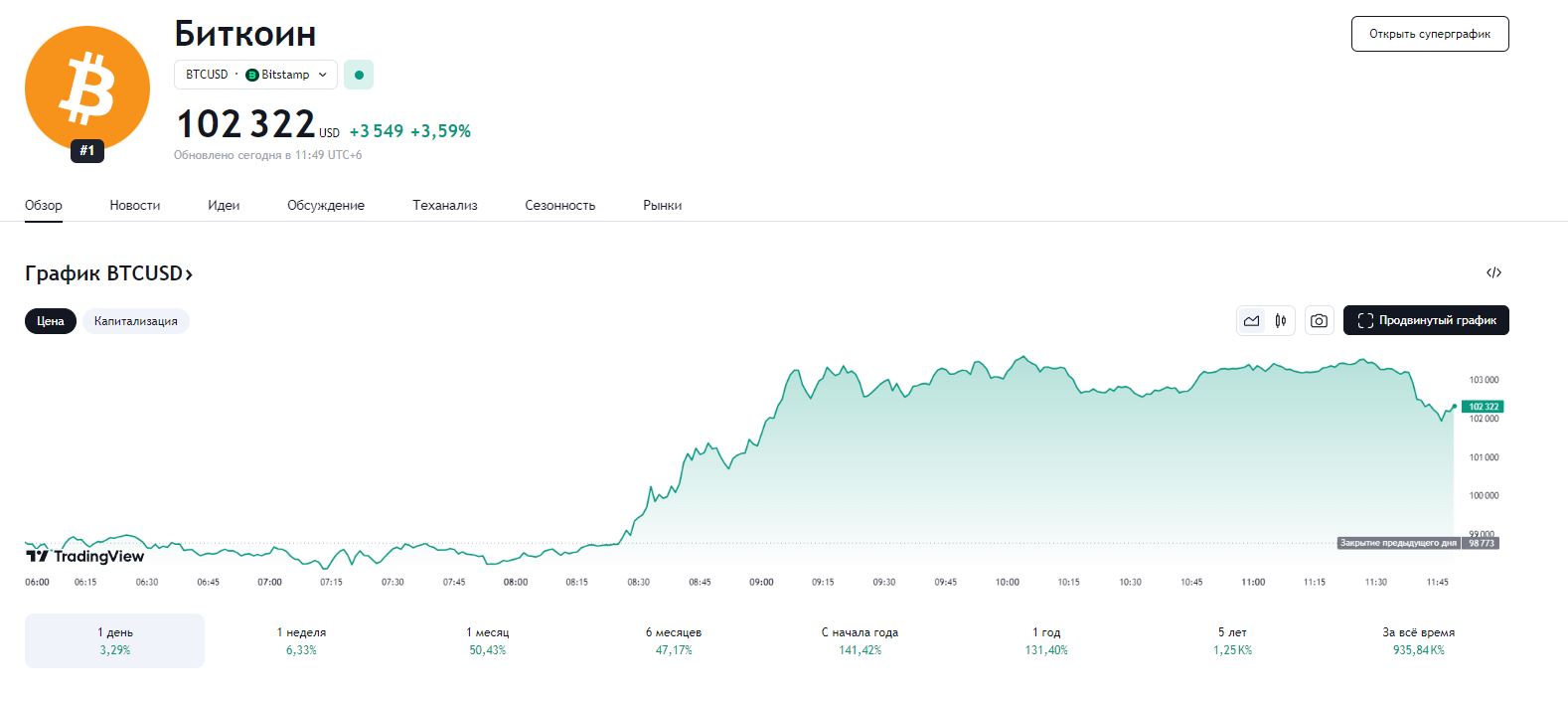

12/05/2024, 12:06The price of Bitcoin has exceeded $100,000 for the first time in history. This opens a new chapter in the evolution of the cryptocurrency market. At the time of preparation of this publication, Bitcoin was trading at $102,322, demonstrating a daily increase of 3.59%. Since the beginning of 2024, the asset’s value has risen by 141.42%. This highlights strong investor interest in cryptocurrencies.

From January to December this year, Bitcoin demonstrated steady growth. In January, its value was around $44,187 (as of January 1). Over this period, the increase exceeded 140%.

This is driven by several factors.

The first factor is institutional interest. Major corporations and institutional investors have increased their investments in Bitcoin, viewing it as a hedge against inflation and an alternative to traditional assets like gold.

Among the major investors increasing their holdings in Bitcoin are hedge funds and registered investment advisors (RIAs). For example, in the first half of 2024, 15 out of the 25 largest U.S. hedge funds, including Millennium Management, Schonfeld Street Advisors and GS Asset Management, held shares in spot Bitcoin ETFs.

This trend is also supported by financial advisors and investment firms such as Cambridge Associates and Hightower Advisors, which have increased their investments in Bitcoin ETFs despite the cryptocurrency’s price volatility.

The second factor is economic instability. Fluctuations in currency exchange rates and global inflation have driven private investors to seek alternative assets to safeguard their capital. In the past, gold was the primary choice in such situations, traditionally regarded as a safe harbor during economic turbulence. However, with the advancement of cryptocurrency technologies and the growing popularity of Bitcoin, many investors have started to consider cryptocurrencies as a comparable hedging instrument.

The third factor is regulatory changes. In 2024, many countries started developing clear legal frameworks for cryptocurrencies, which has increased trust in this market.

In June 2023, the European Union introduced the MiCA (Markets in Crypto-Assets) regulatory framework, establishing unified rules for the cryptocurrency sector. This framework aims to ensure investor protection and enhance the fight against financial crimes. The regulation includes multiple layers of measures that are to be developed before the new regime takes effect (within 12–18 months, depending on the mandate).

Singapore and Thailand have also adopted more flexible regulations to support cryptocurrency markets. Singapore has strengthened oversight of crypto services while continuing to develop the industry and attract investments. In Thailand, restrictions on investments in digital tokens for retail investors have been lifted. South Korea has also enhanced cryptocurrency user protection through new laws requiring crypto exchanges to implement better client data controls.

Finally, the growing popularity of smart contracts and blockchain applications has further boosted interest in major cryptocurrencies, including Bitcoin.

According to market data, Bitcoin remains the most popular cryptocurrency due to its liquidity and long-standing reputation. The average daily trading volume reached $111.19 billion, while the peak market capitalization hit $2.05 trillion.

Bitcoin’s growth is also supported by its limited supply — a maximum of 21 million coins. Currently, 19.79 million coins have been mined, enhancing its appeal as a scarce asset. Analysts anticipate further price increases driven by growing institutional demand and the integration of blockchain technologies into the real economy.