Published

06/09/2025, 17:29At the beginning of the year, international developments became a prominent part of everyday life for Kyrgyzstan’s banking sector. On January 15, the U.S. Department of the Treasury announced the inclusion of Keremet Bank — one of the country's largest banks by charter capital (ranked fourth with 8.6987 billion KGS) — on the OFAC sanctions list. According to the U.S. Treasury, the decision was based on the bank’s cooperation with Russia’s Promsvyazbank, which is already under sanctions, and its facilitation of cross-border transfers since the summer of 2024.

The sanctions took legal effect on March 1, and within just two months, their impact began to be felt across the market.

The most notable change in the bank’s operations has been a sharp decline in client account balances, as reflected in its monthly reports. As of December 31 of last year, client funds held at Keremet Bank totaled 6.6972 billion KGS. By April 30, that figure had dropped to 3.9764 billion KGS. In other words, 2.7 billion KGS — over 40% of the total — was withdrawn from client accounts during this period.

The data show a steady negative trend, which may indicate declining confidence in the bank. A comparison of the same periods in 2024 and 2025 makes the contrast clear. In February 2024, there was a surge in client activity, with the bank’s deposit base increasing by 22.09% compared to January. In 2025, by contrast, the February figure dropped by 13.45%, and the downward trend continued in March (–13.11%) and April (–5.29%). As a result, during the first four months of 2024, the total outflow of client funds was around 13%, whereas in the same period of 2025, it exceeded 40%.

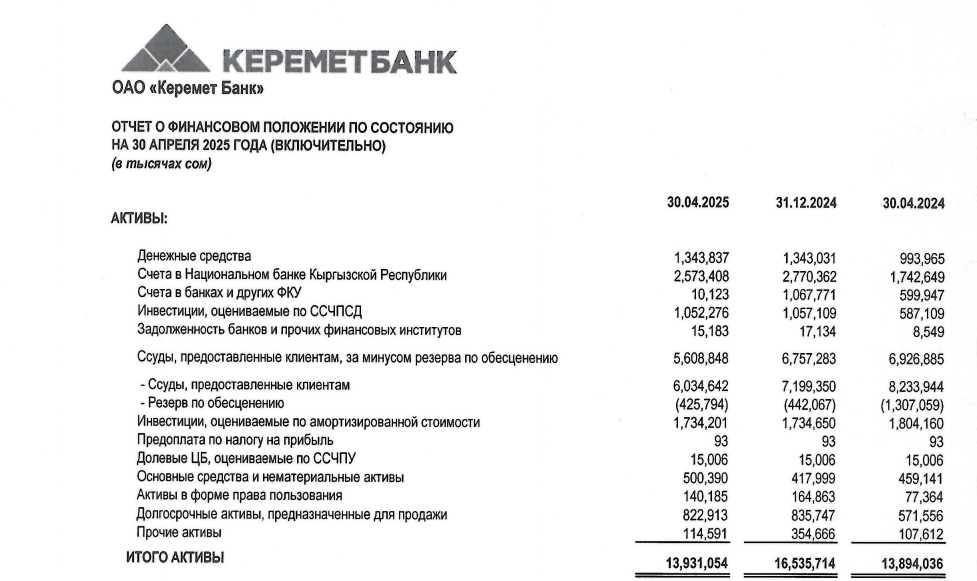

This was also reflected in the bank’s liquidity outflow. The total volume of cash and balances held by the bank in the National Bank and other financial institutions decreased over the same period — from nearly 5.2 billion KGS (author’s note — 1.3 billion in cash, 2.6 billion KGS in the NBKR, and 10.1 million KGS in other financial institutions) to 3.93 billion KGS . The decline was mainly due to a reduction in Keremet Bank’s funds held in accounts with other banks and financial institutions.

Если на 31 декабря 2024 года активы составляли 16.5 млрд сомов, то уже к концу апреля текущего года они снизились до 13.9 млрд сомов. Это отражает общее сжатие баланса и последствия вывода клиентских средств.As of December 31, 2024, the bank’s assets amounted to 16.5 billion KGS, but by the end of April this year, they had declined to 13.9 billion KGS. This reflects an overall balance sheet contraction and the impact of client fund withdrawals.

Nevertheless, under significant pressure, Keremet Bank closed April with a profit of nearly 167 million KGS. This is only 15.7 million KGS (–8.6%) lower than the result for the same period last year. Moreover, the bank showed improvements in several areas. For example, net non-interest income amounted to 35.95 million KGS, whereas in April 2024, this figure reflected a loss of 150.1 million KGS. This turnaround was made possible thanks to:

Operating income increased by 1.6 times: rising from 251.1 million KGS in April 2024 to 412.6 million KGS in April 2025, while operating expenses grew by only 10.3%. This allowed the bank to maintain an efficient margin.

Another important indicator is the accumulated loss, which decreased to 28.9 million KGS by the end of April. This is nearly seven times lower than at the end of 2024 (197.2 million KGS) and 26.5 times lower than in April of last year (764.6 million KGS).

It is worth recalling that Daniyar Amangeldiev, Deputy Chairman of the Cabinet of Ministers, commented on the sanctions situation involving Keremet Bank in an interview with an Akchabar correspondent. He asserted that the bank was not involved in any suspicious schemes and emphasized that the authorities are prepared to provide documentary evidence to confirm this. According to him, negotiations with the American side were scheduled for January 16, shortly after the sanctions were announced. However, the outcome of these talks has not yet been disclosed.

Earlier, Melis Turgunbaev, Chairman of the National Bank of Kyrgyzstan, also explained that after being listed on the sanctions list, the bank has between 30 and 45 days to submit documents that can refute any alleged violations before the sanctions come into effect.

Nevertheless, on March 1, 2025, U.S. sanctions officially came into effect. Five days earlier, on February 24, it was announced that Keremet Bank had also been added to the UK sanctions list as a foreign financial institution providing support to Russia.

It should be added that on March 29, 2024, the Ministry of Finance of Kyrgyzstan acquired 84.8 million common shares of Keremet Bank from the National Bank, representing 97.45% of the authorized capital. The stake was valued at 8.5 billion KGS.

However, by December of the same year, the Ministry of Finance sold 75% of the shares, valued at 6.5 billion KGS, transferring the controlling stake to the Luxembourg-based company Altair Holding S.A. As of the end of the first quarter of 2025, this company remained the bank’s majority shareholder.