Published

07/21/2025, 17:09Bishkek’s residential real estate market continues to show a steady correlation between apartment prices and their vertical placement within buildings. According to an analysis based on sales data from the first five months of this year, apartments located on middle floors consistently command higher prices compared to similar units on the ground or top floors.

The study conducted by the State Agency for Land Resources and Cadastre focused on the southern residential districts of the capital — from the 3rd to the 12th microdistricts, including Asanbai, Kok-Zhar and Ulan. The analysis was based on the most common apartment series: 104, 105, and individually designed layouts.

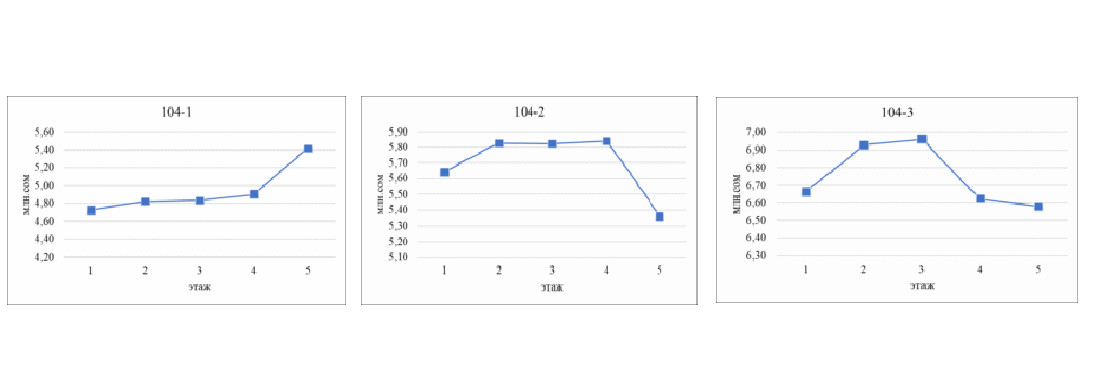

In apartment buildings of the 104 series, two- and three-room units located on the second and third floors maintain a clear price advantage. For example, a two-room apartment on the second floor is, on average, 190,000 KGS more expensive than a similar one on the first floor, and 470,000 KGS more compared to those on the top floors.

For three-room apartments, the price difference between the second and fourth floors exceeds 350,000 KGS, while compared to the first floor, it ranges between 270,000 and 300,000 KGS.

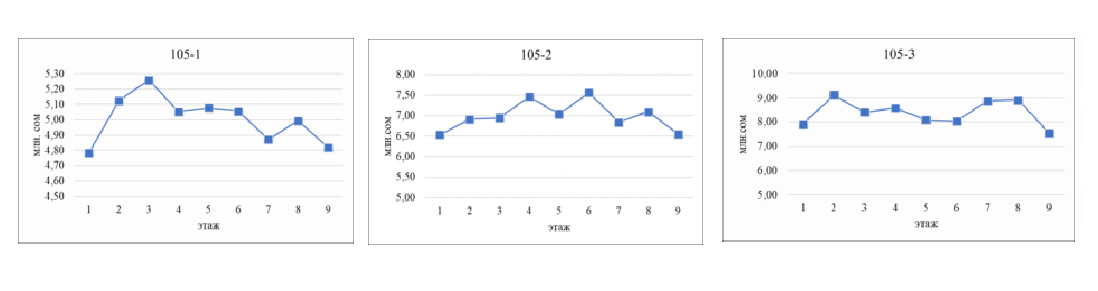

In 105-series buildings, one-room apartments on the third floor are the most expensive, costing 480,000 KGS more than those on the first floor and 440,000 KGS more than those on the ninth.

Two-room apartments located on the 4th to 6th floors show a price difference of up to 820,000 KGS compared to the lowest and highest floors. A similar trend is seen with three-room units, where apartments on the 2nd to 8th floors can cost 650,000 to 1 million KGS more than those on the first or top floors.

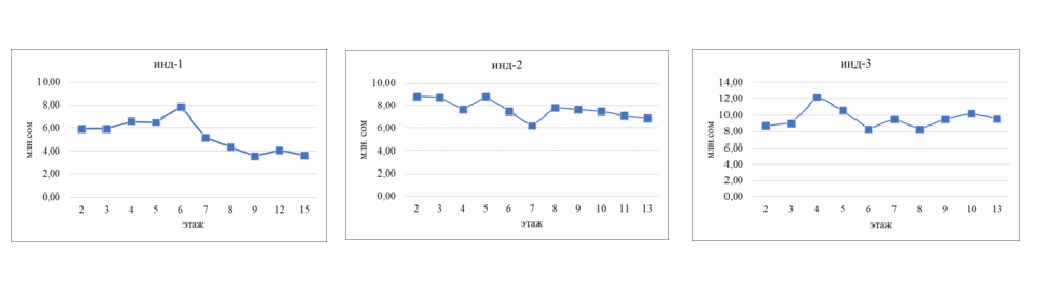

In individually designed apartments, the price advantage for middle floors also holds. One-room ones reach their peak on the sixth floor, two-room on the fifth, three-room on the fourth, and four-room apartments again on the fifth. In all cases, a clear pricing advantage is observed for apartments located between the 2nd and 6th floors.

The strong demand for apartments on middle floors reflects buyers’ preferences for a balance of comfort, infrastructure, and accessibility. The reasons are clear: the ground floor comes with noise, dampness, and constant street activity outside the windows, while the top floor brings heat in summer, cold in winter, and the risk of leaks. In contrast, the second, third, and fourth floors represent the “golden middle” — convenient, safe, and, as the market shows, more expensive.

As Akchabar previously reported, apartments are becoming increasingly unaffordable for the average buyer. By the end of 2024, apartment prices had risen by 27.5%, while the average cost per square meter in the capital reached 95,900 KGS —a 30.7% increase. Amid this rapid price growth, the housing affordability index worsened from 7 to 7.6 years. This means that an average Kyrgyz citizen would need nearly eight years of saving their entire salary to purchase a standard apartment. And this isn’t about luxury housing — it refers to a typical two-room apartment with an area of 54 square meters.

Amid rising housing prices, a decline in real estate transactions has been observed across the country. Overall, the number of transactions fell by 9.1%. In 2024, a total of 27,869 apartment transactions were recorded, reflecting an 8% decrease in market activity.

As apartment prices continue to outpace income growth, reducing overall affordability, some buyers are still willing to pay extra — given equal conditions — for a favorable floor level. This makes floor location one of the key pricing factors in the capital’s real estate market. So if your apartment is neither too low nor too high, consider yourself living at the most valuable spot in the building.