Published

08/05/2025, 12:33As of 1 July, the total amount of cash in circulation was 275.3 billion KGS. Of this amount, 252.7 billion KGS were outside the banking system. This is 17.6% more than in the same period of 2024, representing an increase of almost 37 billion 870.6 million KGS. These figures were provided by the National Bank.

Thus, in the second quarter of 2025, commercial banks received 1 trillion 344.9 billion KGS. This is 6.3% more than in the same period last year. During the same period, the volume of cash withdrawn from banks amounted to 1 trillion 383.4 billion KGS, an increase of 7.2%. In other words, banks issued 38.6 billion KGS more in cash than they received.

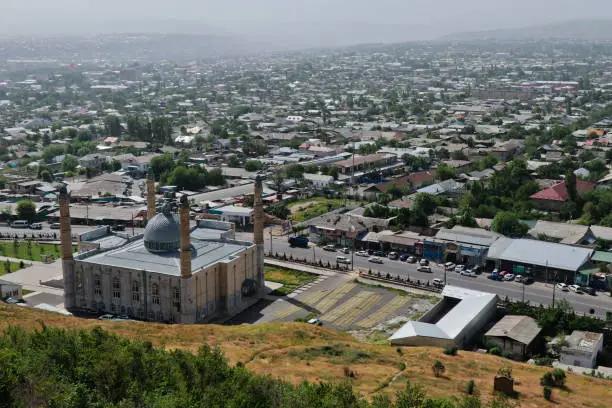

The cash return rate to banks' cash desks decreased, amounting to 97.2% in the second quarter, which is 0.8 percentage points lower than last year's level. The highest return rates were observed in the Osh region (100.3%) and the Chui region (100.1%), while the lowest rates were recorded in the city of Osh (92.5%) and the Jalal-Abad region (92.1%).

| Region | Q2 2024 | Q2 2025 | Deviation |

|---|---|---|---|

| Total for the republic | 98% | 97.2% | –0.8 p.p. |

| Bishkek | 99/6% | 98.6% | –1 p.p. |

| Batken region | 100/2% | 100.5% | +0.3 p.p. |

| Jalal-Abad region | 93/3% | 92.1% | –1.2 p.p. |

| Issyk-Kul region | 95.8% | 96.2% | +0.4 p.p. |

| Naryn Region | 94.1% | 94.4% | +0.3 p.p. |

| Osh Region | 99.8% | 100.3% | +0.5 p.p. |

| Osh | 93.7% | 92.5% | –1.2 p.p. |

| Talas region | 93.4% | 94.7% | +1.3 p.p. |

| Chui region | 100.4% | 100.1% | –0.3 p.p. |

The growth in cash outside the banking system and the decline in the level of returnability in a number of regions indicate the need for further development of the non-cash payment infrastructure and increased public confidence in banking services.