Published

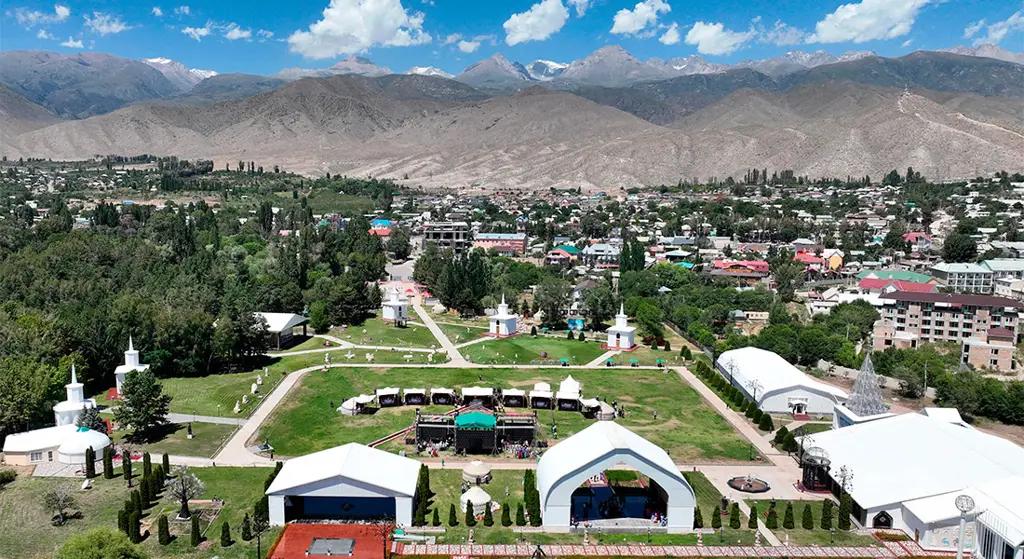

09/13/2025, 09:00In Kyrgyzstan, interest in Islamic financing principles is becoming increasingly apparent. While at the end of 2024 the volume of such services amounted to 9 billion KGS, by July this figure had grown by 61% to 14.5 billion KGS.

Five commercial banks in the country currently offer services in this segment.

The largest growth was in areas familiar to the population, namely mortgages. They increased by almost two-thirds and exceeded 5 billion soms, while consumer financing grew by 82% and approached the 3 billion mark. Agriculture and construction also grew, indicating a gradual expansion of Islamic finance in the real economy.

Structure of Islamic finance:

Of particular interest is the ‘other purposes’ indicator, which has almost doubled since the beginning of the year. This may indicate diversification of demand and product flexibility in this segment.

Interestingly, despite such rapid growth, the level of delinquency has actually decreased. Today, it amounts to only 300 million KGS, or 2.3% of the Islamic finance loan portfolio.